Which Factor in Valuing Your Company Is the Most Important

The objective of the valuation and who does the analysis heavily influences the end result. And when its time read about how to negotiate the best deal.

Seven Critical Business Valuation Factors Mcm Capital

The Mountain Thread Company.

. For public companies market value can be calculated using the stock price. Value Earnings after tax PE ratio. When valuing a business you can use this equation.

Employees should be recognized as a companys greatest asset. Or simply understand your market value understanding how much your business is worth is important for your business growth. It is a non-recourse factoring company meaning your company cannot be held liable if a customer fails to pay.

Corporate finance for the pre-industrial world began to emerge in the Italian city-states and the low countries of Europe from the 15th century. The essential tech news of the moment. We also need to consider two more important aspects for valuing your company.

To get started you must file an application with a sales representative. Provide top-notch customer service. The Dutch East India Company also known by the abbreviation VOC in Dutch was the first publicly listed company ever to pay regular dividends.

The price earnings ratio PE ratio is the value of a business divided by its profits after tax. People drive business organizations and organizational changeAs it turns out the people poised to shape the future are more diverse than ever. Apps venture while adjusting the.

Historic growth is the most impactful factor it is hard evidence that your business has a track record of growth. Its important to keep the employees delighted and contended to ensure that the organization does not lose its customers profits and most importantly market value. To learn more about entrepreneurship check out these small business ideas next.

According to research from Pew Research Center the post-millennial generations entering the workforce will be the most diverse in history. Valuing a company is a difficult task regardless of the size of the businessbut here are some methods that can help. Those extra features on top of offering 97 of the total invoice and a lack of hidden fees make it the best for freight and trucking companies.

Look at your profits and track how theyve changed. One of the most if not the most important ways businesses gain customer trust and confidence is through customer serviceIts the most immediate forum for interaction between both parties and in turn the biggest show-and-prove moment for a business to demonstrate value and legitimacy. All business valuations are estimates.

The most important factor driving innovation said Rajesh Chandy who teaches at the University of Minnesota. And since thread is the common factor in most of the work youll see happen at the shop - baskets quilts and other fiber arts - the name just fits. The connections of family old friendships new community and stunning geography merge in a special way right here in the mountains of North Carolina.

The amount of money that can be received for something. If a company has 100000 publicly traded shares selling at 50 each then its value known as market capitalization is 5M. This approach involves searching for publicly-traded companies that most closely.

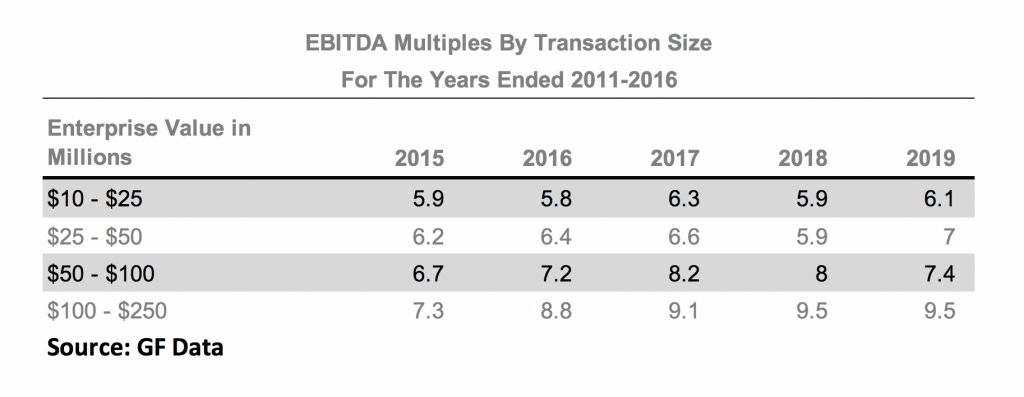

Typically the larger the business the higher the valuation will be. Market value indicates how much a company is worth according to market participants and investors. The importance or worth of something.

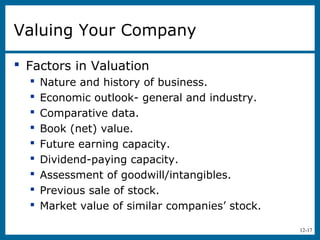

We also help you with the tricky process of valuing your business. How to value a company. Investment bankers valuing a company to take it public want to justify the highest number possible while accountants valuing a company for tax purposes want to arrive at the lowest number possible.

For example a company with a share price of 40 per share and earnings per share after tax of 8 would have a PE ratio of five 408 5. You need to ensure that your company has protected its valuable assets for example a company which has a trademark or patent protecting a vitally important piece of intellectual property is. The VOC was also the first recorded joint-stock company to get a fixed capital stock.

The real fuel and energy behind a companys growth and success come from its people or the workforce. Forget about capital assets when valuing your business. McKinsey Company estimates that through 2030 160 million.

The most common way to estimate the value of a private company is to use comparable company analysis CCA. The researchers mince no words. Company size is a commonly used factor when valuing a company.

Technologys news site of record.

How To Determine What Your Business Is Worth In Five Minutes Or Less

What Factors Contribute To The Valuation Of A Company

No comments for "Which Factor in Valuing Your Company Is the Most Important"

Post a Comment